The Leading Reasons House Owners Pick to Secure an Equity Financing

For numerous house owners, picking to safeguard an equity loan is a tactical economic decision that can offer various benefits. From consolidating financial obligation to undertaking significant home renovations, the reasons driving individuals to decide for an equity finance are impactful and varied (Home Equity Loan).

Debt Loan Consolidation

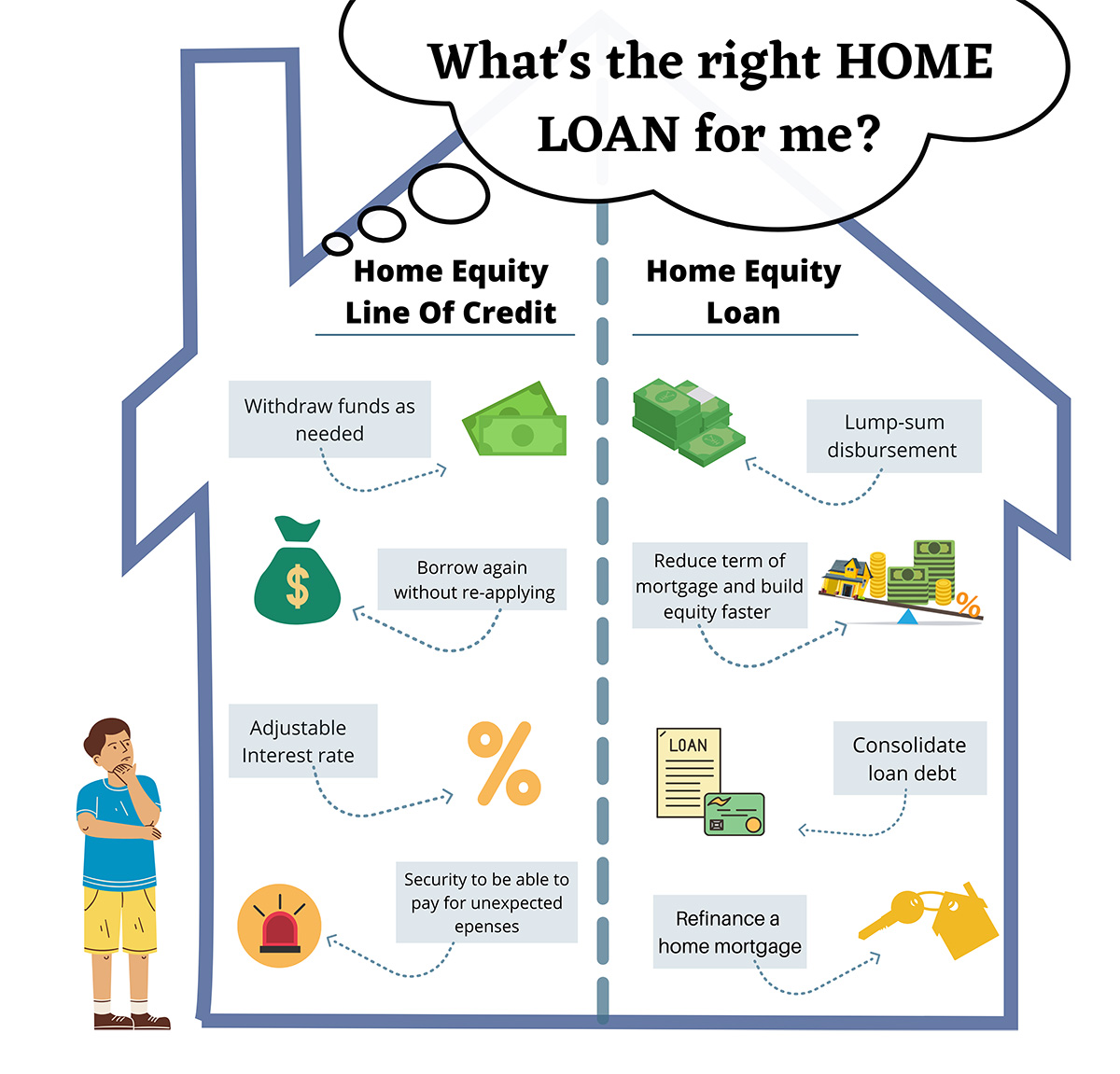

Property owners frequently decide for safeguarding an equity financing as a critical economic step for debt loan consolidation. By leveraging the equity in their homes, people can access a round figure of cash at a reduced rates of interest contrasted to various other types of loaning. This funding can after that be made use of to repay high-interest financial obligations, such as credit card equilibriums or personal financings, permitting house owners to improve their economic responsibilities into a single, extra workable month-to-month settlement.

Financial obligation debt consolidation via an equity car loan can offer a number of benefits to home owners. The lower interest price associated with equity finances can result in significant price financial savings over time.

Home Enhancement Projects

Considering the boosted value and functionality that can be attained with leveraging equity, lots of people choose to designate funds in the direction of numerous home renovation projects - Alpine Credits Home Equity Loans. House owners often choose to protect an equity loan especially for renovating their homes because of the substantial returns on investment that such tasks can bring. Whether it's updating out-of-date functions, expanding living rooms, or enhancing energy performance, home renovations can not just make living rooms extra comfy but additionally boost the total value of the residential or commercial property

Common home improvement jobs funded with equity finances consist of cooking area remodels, restroom renovations, cellar completing, and landscaping upgrades. These tasks not only boost the quality of life for property owners however likewise add to improving the visual charm and resale value of the residential property. In addition, purchasing high-quality products and modern-day style components can even more boost the aesthetic appeal and performance of the home. By leveraging equity for home improvement jobs, home owners can create areas that better fit their demands and choices while additionally making an audio economic investment in their residential or commercial property.

Emergency Costs

In unanticipated circumstances where prompt financial support is required, securing an equity car loan can provide homeowners with a practical option for covering emergency situation expenses. When unexpected events such as clinical emergencies, urgent home repairs, or unexpected work loss emerge, having access to funds via an equity finance can provide a safety net for home owners. Unlike other kinds of borrowing, equity car loans usually have reduced rate of interest and longer settlement terms, making them an economical option for resolving immediate economic requirements.

One of the essential benefits of making use of an equity financing for emergency expenditures is the speed at which funds can be accessed - Alpine Credits Home Equity Loans. Property owners can swiftly tap into the equity constructed up in their residential or commercial property, enabling them to address pushing monetary concerns without hold-up. Additionally, the versatility of equity car loans enables home owners to borrow only what they need, avoiding the concern of taking on excessive debt

Education And Learning Financing

In the middle of the quest of higher education and learning, protecting an equity car loan can offer as a strategic funds for homeowners. Education and learning funding is a significant worry for numerous family members, and leveraging the equity in their homes can give a method to gain access to necessary funds. Equity financings usually supply reduced rates of interest compared to various other forms of lending, making them an eye-catching option for funding education expenditures.

By using the equity accumulated in their homes, property owners can access significant quantities of cash to cover tuition charges, publications, lodging, and various other relevant costs. Home Equity Loan. This can be specifically helpful for moms and dads looking to support their children with university or individuals seeking to enhance their own education. Additionally, the passion paid on equity see loans might be tax-deductible, giving possible monetary advantages for consumers

Eventually, utilizing an equity loan for education funding can help people buy their future earning capacity and job innovation while properly handling their monetary obligations.

Investment Opportunities

Verdict

To conclude, home owners pick to protect an equity lending for various reasons such as debt loan consolidation, home improvement projects, emergency situation costs, education and learning funding, and investment chances. These car loans offer a way for home owners to accessibility funds for vital monetary needs and objectives. By leveraging the equity in their homes, house owners can benefit from lower rates of interest and adaptable settlement terms to accomplish their economic purposes.